As a first-generation college student, I had absolutely no idea what to expect when I started getting financial aid packages in the mail. I didn’t know how to read them, what information was important, what information they based it off of, etc. I was LOST. Throughout four years of university, I’ve gained experience navigating financial aid (fin aid) for myself but also, helping others make meaning of their financial aid packages. I believe that lack of knowledge concerning fin aid packages contributes to the growing debt that millions of U.S. students face when pursuing higher education. SO in the spirit of students going back to school next month, I wanted to make a post about financial aid packages. More specifically, what I WISH I knew about fin aid and the process of appealing. Of course, part of the nature of fin aid is all the difficult terms so per usual the bolded words should be found at the very bottom! 🙂

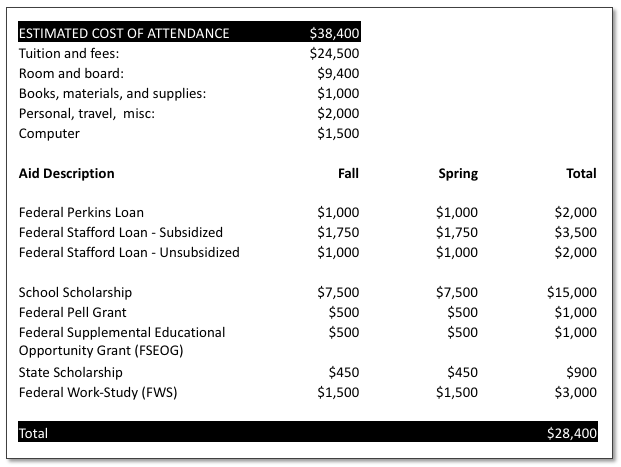

Let’s get started with a screenshot of a financial aid package and we can break it down. You will be well-versed in fin aid packages if you stick with me.

Starting from the top, we’ll go through each of these values.

estimated cost of attendance

Now the key word here is estimated and to clarify, these numbers are for the entire year. They are simply estimated amounts that the university puts together – which means you’re not being actually charged this amount. The exception to this is usually “Tuition & Fees”. These are calculated based on your enrollment and are typically universal for everyone attending that university. The rest of the numbers in this box can change greatly, and here’s why:

“Room & Board”

This basically just means housing and food. I’m sure you can imagine the variety of amounts this could be but here are a few examples.

Housing: If you live in a single on campus, you’d be paying more than if you lived in a triple on campus. If you live at home with your family, maybe you wouldn’t be paying as much if at all.

Food: Perhaps you eat more than the average person, you might want to upgrade your meal plan in which case this number might be higher. Maybe you love to eat out, you should account for the higher values in this section.

For your personal situation, this number can increase ↑, decrease ↓, or be completely on point!

“Books, Materials, & Supplies”

This is an estimate that changes greatly student to student – includes required books, materials, and your school supplies. This value is a little bit lower than I estimated, but it also depends on your major. For students in the Sciences, you will probably have thick textbooks that are on the higher end – around $100-300 (yes, just for ONE book!)

My suggestion: rent these. It’ll save you hundreds of dollars every semester. The most expensive book I had to rent was about $100, but on average you can expect the $60-80 range. And I hear you, that’s still a lot but renting will save you money regardless (or not buying them at all :D). (This is inspiring me to write a whole blog post just for y’all about college textbooks because WOW, there is a lot to say.) I hope this gives you a pretty clear picture of what this estimated number entails.

“Personal, Travel, Misc”

This is pretty much a dump category of whatever else you might need money for in college – a broad category that is, guess what, an estimate! Maybe you treat yourself to a manicure every week or maybe you love to go to sports games (pre-COVID-19 of course!); these are some of the costs that would fall in this category.

Travel is one that many don’t account for but is important to consider. Most people travel in some capacity during their college experience and it all looks different so it really depends on your situation.

Home is Far: For example, maybe you have to fly back and forth to school on breaks. Let’s say Jessie takes $200 flights, 4 times/year (to get there, winter break home & back, summer break home). They would need to account for at least $800 just to get home.

The Commuter: Benni commutes to school which costs them $30/week in gas money. There is also a parking permit that is $300/semester, or $600/year. To calculate these costs, it comes out to be $30 x 16 weeks = $480/semester or $960/year PLUS a yearly parking permit which would total out to be $1560.

With these two examples, you can clearly see the different situations and how the number in this category can vary student by student. “Computer” is going to be put in this category more now than ever because of universities recent switch to virtual due to the COVID-19 pandemic. This was never in my fin aid packages but I love that they include it here. This will vary student to student and in any case, it’s important to consider.

the REST of the fin aid package

Yay, we got through the hardest part: estimated costs! Please remember the categories listed above are simply ESTIMATES, nothing more so I want you to base it on your intended situation and available resources. The rest of this fin aid package will be a bit more straightforward – let me give you a slight break down some of the terms to help with it. (The more well-defined definitions will be at the bottom per usual.)

To summarize, scholarships and grants are basically free money and applied directly to your bill. Loans you pay back but they are also applied directly to your bill. Work-study is a potential money opportunity that pays the student directly over time that can be used for overall student costs.

Scholarships & Grants

Right off the bat, let’s deduct everything we know will be deducted from the bill. The “school scholarship,” the “federal pell grant,” the “federal supplemental educational opportunity grant,” and “state scholarship” are all deducted from the bill. The number left is what I know I need to cover, whether that is with loans, personal money, other scholarships, etc.

Loans

Loans are the complicated part of fin aid packages so I’m going to spend a bit more time on this. Loans are offered to you based on financial need, grade level, and availability. The loans listed here are all federal loans which means the government has certain standards and they are controlled by the Department of Education. Some of these standards include, fixed interest rates, maximum dispersing amounts, grace periods, etc. There are other loans you can get if your financial aid package does not suffice; however, it is not recommended due to higher interest rates and lack of a “grace period.” One thing to note, loans are not “all-or-nothing” which means that you don’t have to accept the full amount. If you are offered $3,500 but you only need $2000, you are able to do that. Also, if you change your mind, you can still access the funds up to the amount on your fin aid package. Even if you decline your entire loan, you can still access these funds later on if you decide you need them. Also, just a friendly reminder NOT to take out loans you don’t need.

subsidized versus unsubsidized

This is a very important distinction to make, both when accepting the loan and when paying back the loan.

Subsidized means the government pays your interest while you are enrolled in school at least part-time (this means different things depending on your university but usually about 6-8 units). This means that the amount you take out is the same amount you will owe back after you graduate and it won’t start accumulating interest until after the grace period (6 months after you graduate). This is the most ideal loan if you must take out a loan.

Unsubsidized means the government does NOT pay your interest while you are enrolled. Essentially, the second you take out the loan, the interest begins. By the time you graduate, that $2k initially could turn into $3k that you need to pay back. This type of loan is still a solid option because of the low interest rates in comparison to a private loan or a bank loan.

Now this is where the importance of knowing the difference between the two loans comes in handy. Let’s say you work the summer after your first year of uni and you save enough to pay off $500 of your loans. This money should go towards the unsubsidized loan because it has already started accumulating whereas the subsidized loan amount remains the same. Remember: lower balance = less money to be paid in interest. The more you chip away at that unsubsidized loan balance, the less it will accrue in the long run. Another example: let’s say you passed your grace period and you are required to make payments on both loans. Knowing the interest rates of both your loans will be key information on how to efficiently pay them off. Typically, the loan with the highest interest is the one to pay off first. This keeps the costs of borrowing money at a minimum. However, if you have a loan with a lower interest rate but a significantly greater balance, you may want to consider paying that one down first. This is just to ensure that the interest on that higher balance makes the cost of borrowing as small as possible. At the end of the day, federal loans are very safe and you benefit from times like this (COVID-19) where legislation has placed all federal loans in forbearance. Student loan debt is not debt that you need to be extremely worried about, though it is still debt.

This was very tedious and there was a lot of new words so if you are confused by this, let me know by replying to this post or messaging me on Instagram. We can go over it together!

Based off what you learned in this post, let’s break down how much this person needs to pay, or how much their “gap” is. To make it easy, let’s assume they only pay tuition, meaning there are no other costs besides tuition.

Yearly tuition is $24,500 and this is what will be billed. Adding up their scholarships and grants, that total is $17,900/year. We can automatically deduct this number from tuition. Now there is a balance that comes out to be $6,600. The loans offered total $7,500. This is where I think many go wrong when figuring out their financial aid package. This person would only need to take out $6,600 of that $7,500. Most people accept the full loan when it’s not entirely necessary. Especially when we think about the difference between subsidized and unsubsidized loans. This person also has access to work-study which they can utilize to help pay down some of that loan during school. Using just these two tips can cut your first-year loan amount in half from $7,500 down to $3,600. This is only with the funds being offered as well. This does not include any other jobs, gifts, or outside scholarships that one receives. Let’s say this student got a local scholarship through their high school totaling $1,000/year and for their birthday they collect $200 from friends and family. They choose to use this money to fund their education / pay down loans. Using all of these tips, this individual’s total of $7,500 in loans after one year in university turns to $2,400. Over a span of 4 years, this person could have accumulated upwards of $30k in student loan debt whereas using these tips, they are hovering just under $10k. Escaping student loan debt altogether is unlikely but there are some ways to make it easier.

Hopefully this post gave you a better idea on how student aid packages work and what you can do to minimize costs and maximize your money. If you have any questions about ANYTHING, feel free to hit me up! I’d love to help you organize your financial aid package and make it make sense!

fixed interest rates: “fixed” simply means that it will never increase for any reason. The interest you see when you take out the loan, is the same interest rate for the duration of the loan. An interest rate is just how fast or slow your debt from that loan will accumulate. For federal student loans, the interest rates usually hover between 3.75-4.5%. This is fairly low; in comparison to private loans that may be in the 5-6% range.

maximum dispersing amounts: the government puts a cap on how many students loans one can accumulate. Below is a table I grabbed directly from the federal student aid website. As you can see, there are different limits from different students and they vary greatly. I’m not sure how they come up with these numbers but they do exist and it may be helpful to know about them.

grace periods: a grace period is this beautiful amount of time after you graduate to pay back your loans. Typically it’s 6 months after graduation, but if you’re lucky it’s a bit closer to the 7-8 month mark. This period of time is extremely important to know about for 2 reasons: making payments before the grace periods ends will help your overall cost go down and lessen the amount of payments you have to make.

forbearance : a period of time where you are not obligated to make payments and your interest rates lowers to 0% due to extreme circumstances. Currently as I write this, the government enacted forbearance on federal student loans from March 13th, 2020 until September 31st, 2020 due to the COVID-19 pandemic. I’m not sure it’s a common occurrence so don’t count having a period of forbearance.